D+TB is an authorised customs representative registered in Belgium under #2259, and authorised in France under #6101 and the Netherlands #NL00740328392. AEO-driven, predictable lead times and pragmatic advice.

📩 Send us your customs requestD+TB is officially recognised by the Belgian Customs & Excise Administration and listed in the Belgian register of customs representatives under number 2259. In France, D+TB operates under number 6101 and in the Netherlands under NL00740328392.

Our services principally cover formalities performed on Belgian territory (notably at the auxiliary offices of Zeebrugge DA, Mouscron DAE, Antwerp DAE, Zaventem D, Grâce-Hollogne (Bierset) DAE, Ghent DAE, Aalst DAE, Arlon DAE, Bilzen DAE, Brussels DAE, Gosselies DAE, Eynatten DAE, Geel DAE, Ottignies-Louvain-la-Neuve DA, Tienen DAE and Vilvoorde DA), on French territory (Calais, Dunkirk, Caen, …) and on Dutch territory.

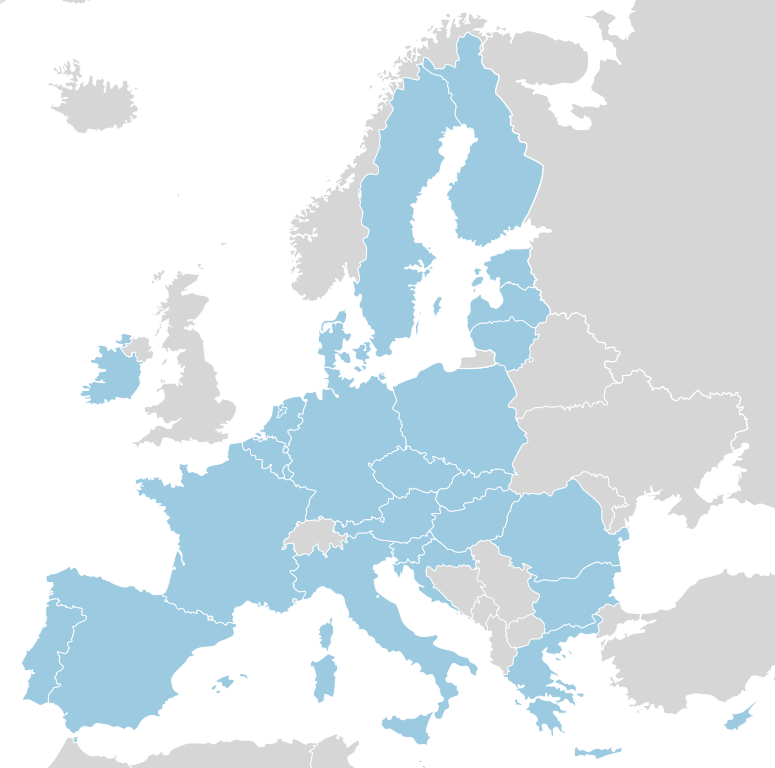

With the appropriate customs authorisations in place, we can also support you wherever the goods are located within the customs territory of the European Union.

Streamlined processes, fewer delays and predictable lead times thanks to our quality framework.

VAT on importRepresentation

Yes!

When you transfer your regular place of residence from a non-EU country to the EU, it is necessary to declare the personal goods (including your vehicle) that you are bringing with you to customs.

If all conditions are met, the customs authorities may grant you an exemption from the import taxes in question when importing your personal belongings.

Yes!

Non-established taxable persons performing VAT-taxable operations in Belgium (such as the importation of goods) can appoint a fiscal representative instead of registering for VAT themselves.

One of the practical advantages is that the represented party does not need to obtain its own Belgian VAT number for the covered operations.

D+TB is authorised to act as a fiscal representative for non-established entities in Belgium and uses a model agreement consistent with the applicable administrative framework.

No. We act exclusively as a direct representative.

Yes. We can open NCTS transit for routes within the EU and in countries participating in the Common Transit Convention such as the United Kingdom and France.

Yes. We assist with new authorisation applications and with maintaining existing ones (including AEO processes).